Growth

Southeast Asia’s largest economy, Indonesia, is currently undergoing a full-scale economic transformation fuelled by the $1.4 trillion GDP landmark achieved this year – its highest yet. Backed by million-dollar investments and ambitious government initiatives, the country is aiming to set new targets for its financial sector going forward.

Though several structural obstacles stand in the way – notably infrastructure gaps and financial inclusion challenges – ambition remains fervent. Indonesia’s government, harbouring aspirations similar to those of any emerging economy, is determined to push forward a future-ready, digitized financial ecosystem.

What’s the bigger picture? Financial markets expanding at unprecedented speed, building a bigger economy; further widening access to banking and credit, and accelerating fintech innovation – all part of Indonesia’s goal to shape a modern, competitive financial ecosystem.

But the path ahead demands caution, consideration, and coordinated planning – starting with a closer look at the forces shaping the country.

Who Makes Up Indonesia?

People, places and patterns.

To better understand where Indonesia’s FSI sector is headed, it is essential to have a clear view of its industry landscape, starting with the country’s most crucial asset – its people.

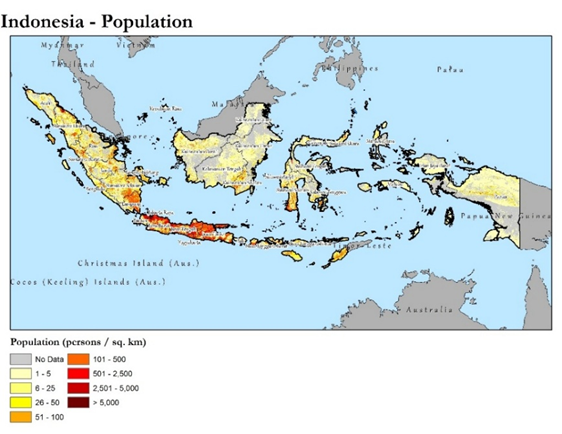

The archipelagic country is home to about 284 million people, distributed unevenly across its islands. Java – the country’s principal island – holds over half the population, while outer islands remain sparsely populated.

Parallel to this scattered populace is a steadily growing working-age group, which gives Indonesia a demographic dividend, i.e., a potential source of faster growth if education, jobs, infrastructure, and the environment keep pace.

With regards to internet access and mobile penetration, Indonesia has roughly 229 million internet users as of 2025, representing 80.7% of its population, and over 356 million SIM card connections.

This contradicting coexistence of dispersed rural settlements alongside high urban demand for digital services has fundamentally shaped how the country’s financial services industry designs products, distributes services, and engages its customers.

One of Indonesia’s key priorities, therefore, is to bridge these gaps and promote complete inclusivity – ensuring financial services and access reaches all. Through initiatives such as the Inclusive Financial Ecosystem (EKI) Program led by the Financial Services Authority (OJK) – including the National Financial Inclusion Strategy (SNKI) coordinated by Bank Indonesia, the PROMISE II Impact Programto support MSMEs in remote regions, and the launch of ‘branchless banking’ networks like BRI’s BRILink agents – the country has demonstrated remarkable efforts to make affordable, reliable financial services universal.

But how exactly does Indonesia intend to reshape its financial sector – worth US$880 billion – in the coming decade? More importantly, what is the country aiming to achieve with its trillion-dollar economy going forward – and what does that mean for potential investors and industry stakeholders?

Paper to Practice, via Industry Muscle

As essential as policies and frameworks are to help set direction for progress, practical outcome is only possible through decisive, coordinated action – i.e., cohesive collaboration between industry leaders, technology innovators, regulators, and other stakeholders – working together to translate policies into measurable change.

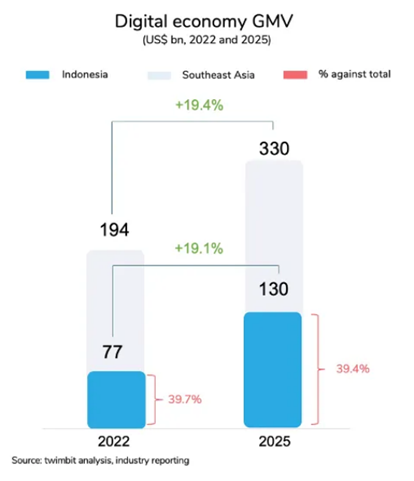

And this, as of recent, is taking place in the country in record numbers. Indonesia’s industrial and digital sectors have entered a new phase of mass expansion. The country’s digital economy is fuelled by rapid adoption of e-commerce, fintech, and AI-driven services across manufacturing, logistics, and healthcare. Major investments in datacentres and renewable energy are strengthening the backbone of this growth, while new opportunities in cloud computing and artificial intelligence are reshaping how businesses scale and compete.

While change is evidently taking place, enhanced efficiency and rapid advancements are needed still. Newer, better technological solutions and data-led approaches are prerequisites. And as neighbouring nations progress simultaneously, Indonesia’s financial competitiveness must be consistently strengthened through regulatory clarity, innovation, and cautious investments. With newer governments, industry giants, financial supervisors, trade authorities, and technology commissions, the country’s landscape needs constant and consistent reshaping – to keep pace with evolving priorities.

And is this being fulfilled? Not entirely – not yet.

Progress and momentum can easily scatter without a forum to channel them into shared priorities and actionable plans. The sector, therefore, needs spaces where regulators, innovators, and market leaders can align visions, examine obstacles, and commit to common solutions that scale. It’s here where well-designed platforms prove to be indispensable.

Because, as the saying goes, if you want to go fast, go alone; if you want to go far, go together.

The Demand for Summits

The catch here is this – change, especially in a complex and fast-moving sector like fintech, does not happen solo. It requires collaborative dialogue and the willingness of multiple voices to align on common priorities for action.

In Indonesia’s rapidly evolving financial landscape, such dialogue is fragmented more often than not. Regulators struggle to keep pace with innovation – as evident in the delayed regulatory oversight of crypto assets, which only shifted from Bappebti to OJK in January 2025 – while start-ups and incumbents operate in disconnected pockets, and emerging innovative solutions risk going unnoticed without a space to test, debate, and refine them.

What the sector truly needs are platforms that bring together these diverse perspectives, creating structured opportunities for conversation, insight-sharing, and collaborative problem-solving. Which is to say, spaces where innovation can meet policy, ideas can be challenged constructively, and solutions can be scaled expansively.

Only through such forums can scattered momentum be transformed into coordinated, sustainable progress.

And this is where the World Financial Innovation Series (WFIS) emerges as the most vital platform for Indonesia’s FSI sector. Organised by Tradepass, a leading global B2B events organizer, WFIS provides the space for ideas to be tested, assumptions challenged, and solutions exchanged — all supported by carefully designed networking opportunities.

As Indonesia’s financial services industry steps into a decisive new chapter, the need for thoughtful collaboration has never been greater. Technology will keep advancing, customer expectations will continue to evolve, and new players will enter the market. But without spaces where dialogue, policies, and innovation meet – progress risks becoming uneven, and eventually, stagnant.

As the seventh edition of WFIS prepares to return – a prestigious summit that matters most profoundly for the country – its purpose is clear: to give the country’s most influential decision-makers the insight, tools, and partnerships needed to build a thriving financial future; one in which technology and collaboration work hand in hand to drive meaningful, lasting change.

Tradepass, the organising body,looks forward to welcoming leaders, innovators, and regulators once again – fostering connections, sparking solutions, and setting the pace for Indonesia’s next wave of financial innovation.