South Korea bets on electronics, Taiwan on semiconductors, Singapore on manufacturing, and Hong Kong on finance – and that’s part reason why their economies are flourishing today, voraciously growing manifold over the years and rightfully earning themselves the big ‘Four Asian Tigers’ title.

However, surrounding these trillion-dollar tigers – who’ve long reached advanced industrial maturity; boasting world-class infrastructure, top-tier education systems, and globally competitive technologies – are younger, eager nations harbouring untapped markets, abundant labour, and a hunger for growth.

Termed as Southeast Asia’s Tiger ‘Cubs’– Indonesia, Malaysia, the Philippines, Thailand, and Vietnam have emerged as one of the region’s fastest growing economies, ranking high in the fields of fintech, cybersecurity, and digital innovation. With per capita incomes surpassing previous years’ averages, and millions in private sector investments pouring in, these nations hold both potential and capacity to sustain and accelerate their growth.

While they’re busy carving out their trajectories for the coming decade, Vietnam in particular seems to be in need of a slightly unique approach.

“The country needs to make multiple big bets,” Said Richard McClellan – former Founding Country Director for Vietnam – emphasizing that Vietnam’s economy can’t rely on a single sector for long-term growth. Considering the complex structure of it, i.e., a diversified industrial base, an expanding consumer market, an evolving digital ecosystem with the constraints of a still-developing infrastructure and workforce readiness, the country will be in need of bold, coordinated strategies.

Therefore, unlike how South Korea focused on electronics, Taiwan on semiconductors, and Hong Kong on finance, Vietnam would have to make strategic investments across multiple sectors to remain competitive, as ‘cheap labour’ is no longer the country’s main advantage.

Vietnam’s Demographic Dilemma

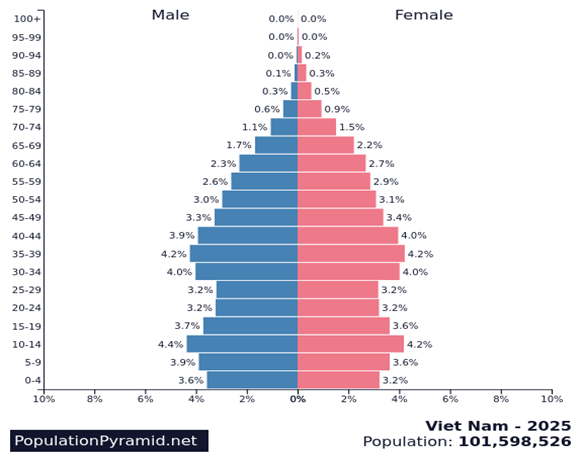

While a 100 million people are a powerful asset – it has both favoured and strained Vietnam, i.e., presented both economic opportunity as well as developmental pressure.

On one end, a large working-age population has enabled Vietnam to robustly fuel its manufacturing sector – attracting FDIs and expanding the country’s role in global supply chains. On the other, it has created systemic bottlenecks: underdeveloped infrastructure, workforce skill gaps, urban congestion, and rising social service demands.

The country is also gradually ageing. While not as acute as Japan or South Korea, Vietnam’s median age is rising, and dependency ratios will increase over the next two decades. If productivity doesn’t outpace these demographic shifts, the country’s growth could slow down. And while the country aspires to transition from a ‘Tiger Cub’ to a more mature, innovation-led economy like its neighbours, these constraints require meticulous strategy – neglecting which might risk undermining Vietnam’s long-term progress.

In this complex landscape, the financial sector plays a crucial role. As the country navigates dual pressures of a large and ageing population, focus falls on sectors that can multiply productivity, absorb labour at scale, improve capital flow, and drive inclusive, sustainable growth. Therefore, chief among these sectors turn out to be finance and digital innovation.

While population expands, pressures mount, expectations of the urban middle class rise, and demand for better public infrastructure surges; financial systems – as backbone to all concerned functions – must evolve in tandem. They must reform and digitize themselves to match the volatility of Vietnam’s demographic landscape.

By the Numbers: The Financial Sector’s Role

Vietnam’s GDP was valued at approximately US$476 billion in 2024, and is set to reaching $500 billion this year with growth targets at least 8%. By 2030, the country aims to double the size of its economy, and hope to move closer to a trillion-dollar mark.

A major contributor to this has been a combination of export-driven manufacturing, rising domestic consumption, steady inflows of foreign investments (FDIs), and the government’s push for digital and financial innovation.

In 2024 alone, Vietnam attracted US$38.23 billion in registered FDI, with disbursements hitting a record US$25.35 billion – the highest in its history. The majority of this capital went into processing and manufacturing, particularly in high-tech industries.

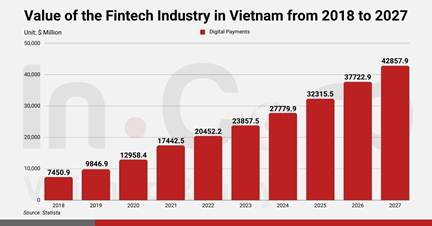

At the same time, the country has steadily expanded its digital economy, which was valued at over $30 billion in 2023, and is projected to reach $45 billion by this year. Financial services – particularly digital banking and fintech – have emerged as key enablers of this shift, supporting greater access to credit, payment systems, and capital allocation across sectors.

Finance & Tech: The New Engine

If the past decade for Vietnam’s economy was defined by manufacturing and foreign investments, the next will be driven by financial innovation and digital technology – because fintech has transformed how people in Vietnam pay, borrow, and invest. Mobile wallets now process millions of transactions daily; digital banking platforms are increasing access to credit; and blockchain-powered solutions are emerging for all financial services. These innovations are not just conveniences for the urban middle-class, but entire gateways to economic participation for the unbanked, who make up a large portion of the population.

Additionally, the government’s National Digital Transformation Program intends to push the country towards a cashless society by 2030, with ambitious targets to digitize public services, scale e-payments, and expand digital literacy.

Pair this with the country’s young, tech-savvy demographic, and Vietnam can position itself as Southeast Asia’s laboratory for innovative digital finance.

But opportunities come with setbacks. Cybersecurity risks are mounting, and regulatory frameworks must keep pace with such rapid innovation. Moreover, without careful planning, digital adoption could deepen the divide between urban and rural communities. If left unaddressed, these risks could undermine investor confidence and slow down Vietnam’s complete growth.

All of this gives rise to several key questions that demand answers.

- How can Vietnam build a regulatory environment that fosters innovation and ensures stability?

- What kind of partnerships are needed to help expand digital financial services across sectors?

- How can fintech be leveraged effectively to close the gap between urban and rural communities?

- How can fintech solutions be designed to reach rural households, women entrepreneurs, and small businesses – which is to say, all of Vietnam?

- And, perhaps the most important one; what do the next 5 years look like?

The Road Ahead

Vietnam’s bet with digital finance will hold lessons for other emerging economies across Asia and beyond, by showing how young nations can combat developmental hurdles through innovative technologies.

But the road ahead needs carefully calibrated policies, closer collaboration between regulators, banks, and industry leaders, and – above all – spaces where these stakeholders can trade ideas and forge partnerships. Therefore, what is needed most at present in countries such as Vietnam, are platforms where such conversations can unfold.

One such forum that has enabled serious dialogue and collaboration across Vietnam’s FSI landscape is the World Financial Innovation Series (WFIS) – by Tradepass – which has established itself as the most sought-after, pioneering platform of its kind.

With a flagship fourth edition coming to Hanoi soon, at Meliá Hanoi, on 19 – 20 May 2026, the WFIS will bring together more than 500 industry professionals; technology leaders, regulators, banks, insurance firms, digital lenders, microfinance institutions, and more – whose collaboration via panel discussions, innovative exhibitions, and guided networking meetings will help develop clear, actionable strategies for the country’s FSI trajectory. By convening the best minds of Vietnam’s fintech industry under one roof, WFIS will help turn long-term goals into practical outcomes that strengthen and support the country’s financial ecosystem.

The event’s rigorous 2-day agenda reflects Vietnam’s evolving financial landscape: accelerated digital adoption, the rise of embedded finance, open banking, cloud-native infrastructure, and regulatory initiatives such as the fintech sandbox and digital banking. These are exactly the kind of domains where Vietnam can gain momentum in the long run, and push its economy out of its ‘Cub’ status.

The Big Catch

While Vietnam holds significant economic potential owing to a large working-age population, with a GDP growing at a steady CAGR of 6%, it also faces severe setbacks due to an underdeveloped infrastructure and significant gaps in financial inclusion.

Given that finance runs all economic activity, and – in the age of all-things-internet – only digitization guarantees long-term growth, Vietnam must therefore shape all its policies and initiatives around technological innovation in finance so it can push its economy in the necessary direction forward, if it wants to catch up to be the next Asian tiger.

Platforms, like the ones Tradepass creates, contribute significantly to these advancements. Dialogue instigates partnership, and partnerships produce collective actions – which, when translated into product innovation, regulatory sandboxes, pilot projects, and market-wide collaborations – help modernize financial services, widen access, and build resilience across Vietnam’s economy.

By aligning strategy with innovation, Vietnam can not only bridge its infrastructure and inclusion gaps, but also set a benchmark for how emerging markets can make bold leaps towards a digitally empowered financial future.