Indonesia’s banking story is being re-written by regulators, investors, industry giants, fintech institutions, and millions of young, tech-savvy, digital-first consumers reshaping how money moves.

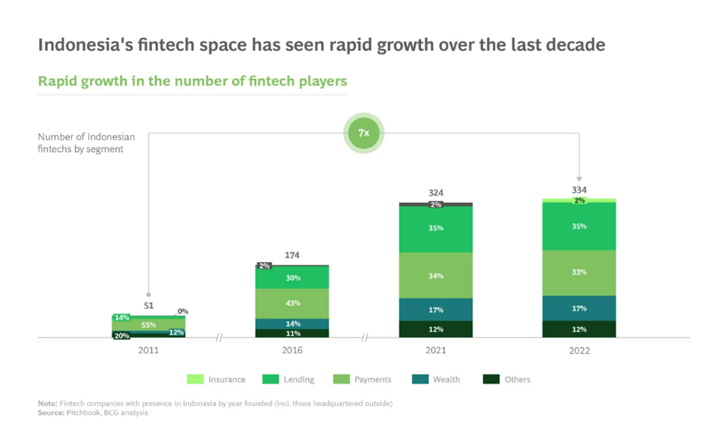

Further pushed by global players eyeing the largest economy in Southeast Asia, Indonesia’s fintech services market was valued at about USD 8.6 billion in 2024, and is further projected to reach USD 32.5 billion by 2032. Such rapid growth was possible due to several factors – accelerating smartphone penetration, supportive regulatory reforms, an expanding digital infrastructure and increased availability of fintech platforms – all of which make one thing clear: FinTech is outpacing the country’s traditional banking sector.

Why?

To sum it up briefly, Indonesia’s traditional banks have historically been slow in keeping up with fintech innovation. Many large banks were built on legacy systems, branch-heavy models, and risk-averse approaches; who struggled to deliver user-friendly apps, fast loan approvals, or innovative products. This created a huge gap in meeting evolving customer expectations.

Such gaps were therefore filled in by fintech start-ups, who provided various digital financial services such as e-wallets, peer-to-peer lending, buy-now-pay-later schemes and more, through platforms like GoPay, OVO, Dana, ShopeePay, and others. Since these services were mobile-first and user-friendly in design, and made for low-ticket, everyday transactions, their growth outpaced banks significantly. At USD 8.6 billion, Indonesia’s fintech sector has outpaced the traditional bank sector.

Big Eats Small

It goes without saying that innovation at its most impactful – to serve the evolving needs and expectations of a populace – must be encouraged. But in the case of managing public money, which is contingent on consumer data protection, cybersecurity, credit risk, and financial stability; raise concerns when handled by fintech institutions. Though they have proven their ability to innovate faster than banks, they lack the safeguards, accountability measures, and systemic oversight essential to a country’s financial backbone.

Therefore banks, despite their limitations, are the pillars of a nation’s financial ecosystem and its stability – operating under strict regulatory control and backed by strong deposit insurance systems.

The challenge, then, is not to choose between banks and fintechs, but to create a balanced ecosystem where both can co-exist. Fintech platforms drive inclusion, convenience, and rapid adoption of digital services, while banks provide the governance, risk management, and structural stability that protect consumers and the economy.

Therefore, Indonesia’s best, most practical and feasible path forward would be to foster collaboration between these private and public institutions — the two pillars of the country’s financial sector. By encouraging innovation within a regulated framework, and ensuring that growth in the digital financial sector does not come at the expense of systematic security and public trust, the country can accelerate financial inclusion, modernize its banking infrastructure, address its technological gaps, and position itself as a leading digital economy in Southeast Asia.

How the Regulators Stepped In

Seeing the rapid momentum – and hence, the risks – of fintech institutions outpacing banks; Bank Indonesia and OJK started building frameworks; not so much to push banks forward, but to ensure fintech growth didn’t destabilize the system.

It can be said that regulatory support, in this sense, means creating sandboxes, licensing regimes, protecting consumer standards, and encouraging collaboration between the two far-end institutions; i.e., the private and the public, in order to encourage innovation within regulatory compliance. The government also wants banks to ‘catch up’ in the digitization race, to better serve evolving consumer needs, and effectively bridge all other infrastructure and inclusivity gaps.

It started with the establishment of OJK – Otoritas Jasa Keuangan, the Indonesian Financial Services Authority, in the year 2011; an independent government body responsible for regulating and supervising Indonesia’s financial services sector, including banks, capital markets, insurance companies, and financial technology firms – aimed to protect consumers’ interests, promote a competitive financial industry, and ensure public trust through comprehensive supervision and enforcement of financial regulations.

All new fintech institutions and platforms are therefore mandated to comply with OJK’s licensing, supervision, and consumer protection requirements before commencing operations – for the best of public interest. Any new service, or solution – such as digital wallets, peer-to-peer lending platforms, buy-now-pay-later schemes, or mobile banking applications – must pass all government evaluations and standards for security, transparency, and risk management, before being allowed to serve consumers.

How the Banks in Indonesia Want to Respond

While fintech institutions have pushed Indonesia’s fintech market past the billion-dollar mark, and undeniably helped the nation position itself at the forefront of ASEAN in terms of digital competitiveness, it is crucial to both regulate and oversee such rapid digital expansion.

The main question remains: how do Indonesian banks intend to compete and collaborate with the fintech sector? As has been demonstrated over the past few years, they’ve counter-contrived with a similar range of digital initiatives, and are in the midst of launching newer ones each year.

To mention a few – BCA Digital, Jenius (BTPN), and Bank Mandiri launched neo-banking and app-led models; digital products that target tech-savvy consumers with mobile-first services. There has also been a surge of strategic partnerships between banks and financial platforms – such as digital wallets and lending programs – to extend the banks’ reach. Various initiatives such as branchless banking, micro-loans, and targeted digital products have been launched to better serve underbanked populations as well.

There have also been significant investments in technology, the most recent one of which was by Bank Mandiri, BRI (Bank Rakyat Indonesia) and BCA (Bank Central Asia), which included AI-driven credit scoring, fraud detection systems, and enhanced mobile banking platforms – aimed at improving risk management, operational efficiency, and offering personalized digital services to customers.

In short, banks in Indonesia are both aware of the growing competition in financial servicing and are, in response, actively countering them by accelerating digital transformation, launching mobile-first products, forming strategic fintech partnerships, and investing in advanced technologies.

What’s Next?

Long-term growth. For both.

The future is abundantly clear: AI and the internet will infiltrate and reshape all things. For Indonesia, the key to sustaining their financial growth is coordinated, systematic collaboration between their banks and other fintech institutions, who need each other’s strengths. By combining regulatory experience and systemic stability with fintech agility, innovation, and consumer-first digital solutions – the country can hope to modernize its banking infrastructure, expand financial inclusivity, and bridge technological gaps.

What’s needed, hence, are platforms where such collaboration takes place. Where the best minds from both sectors meet, exchange insights, co-develop solutions, pilot new initiatives, share cutting-edge solutions, and establish practices that effectively address both innovation and regulation.

One such platform is the World Financial Innovation Series (WFIS) Indonesia, organized by Tradepass. This event – held each year over the past 6 – serves as a significant gathering for the financial services industry in Indonesia. The 2024 edition last year, held on November 12 – 13 at Raffles Jakarta, attracted over 600 professionals; constituting industry leaders, regulators, investors, senior executives, and technology providers from Indonesia’s banking, insurance, and microfinance sectors – all converging under one roof to discuss the country’s evolving financial landscape.

Notable speakers at the event included Juda Agung, Deputy Governor of Bank Indonesia, and Ridhony Marisson Hasudungan Hutasoit (Analis Senior (Stk. Kepada Bagian) Deputi Direktur Pengaturan Pengawasan Perilaku Pelaku Usaha Jasa Keuangan, Edukasi dan Perlindungan Konsumen) from the Financial Services Authority (OJK) – who divulged the respective sectors’ growth patterns; i.e., analyzed what worked, what didn’t, what can, and what must – to guide the future of the country’s financial ecosystem, and strengthen its position as Southeast Asia’s leading digital economy.

By fostering dialogue and practical collaboration in a structured environment, such gatherings help ensure that Indonesia’s digital transformation is controlled, coordinated, inclusive, and aligned with regulatory standards. Such a platform helps set direction, and action. For more information on the upcoming event, visit https://www.indonesia.worldfis.com/